Innovation portfolio management is a foundational element for companies looking at new opportunities to grow their business. If you’re leading a company’s growth initiatives through investment in new ideas, there are five critical questions you need to consider to ensure an appropriate return on investment and few relate to financial objectives.

Five critical questions for innovation portfolio management

- What’s innovation success look like for your organization?

- Has funding been allocated and how secure is it?

- What’s the time frame to see benefits from innovation initiatives?

- Do you really have buy in?

- Does your organization have a high level of trust?

1. What’s innovation success look like for your organization?

Get this definition clear, because there are going to be a lot of varied outcomes and you’ll need to measure against them.

It’s not all going to be ROI (return on investment). You’ll get positive ROI – in the long run, and with consistent effort. There will also be a lot of failures, learning opportunities and the living dead – and that’s just for the “safe” bets. Ideas that are truly game-changing need to be on a different track for measuring progress. This is spelled out nicely in the discussion of transformational innovation in the HBR article on Managing Your Innovation Portfolio.

The majority of innovation will go through a variation of stage-gating where funds are allocated where traction is seen and milestones are reached. It’s the same formula startups go through, just with the enterprise flavor. With your limited funds, knowing what you’re setting out to accomplish and understanding if you achieved that goal is vital.

2. Has funding been allocated and how secure is it?

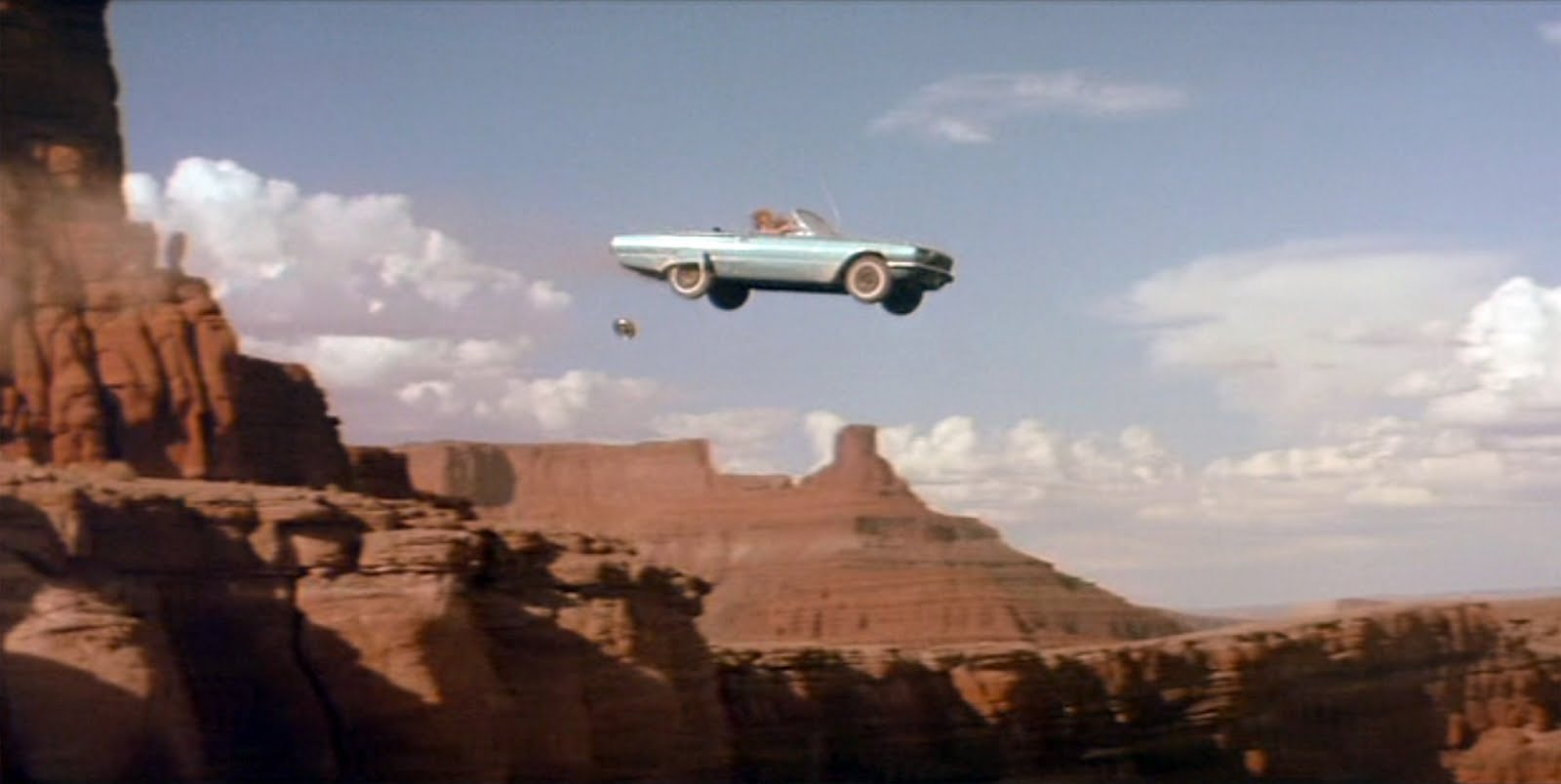

Entrepreneurs know their runway. You hit the end and you’re done. You work hard to make sure you don’t get there – showing traction so that follow on investment occurs, or being cash flow positive is letting you live another day. I’ve been in that Thelma & Louise moment where the startup is going off the cliff only to see the road reappear under our wheels.

Entrepreneurs know their runway. You hit the end and you’re done. You work hard to make sure you don’t get there – showing traction so that follow on investment occurs, or being cash flow positive is letting you live another day. I’ve been in that Thelma & Louise moment where the startup is going off the cliff only to see the road reappear under our wheels.

On the corporate side, I’ve also seen budget support get pulled away to make quarterly numbers. It’s hard enough knowing the odds are against you and the competition is trying to kill you. You shouldn’t have to worry that your funds are going to disappear from your bank account. And if you’re working on a truly disruptive idea, it’s going to need sustained, and sometimes significant, investment.

3. What’s the time frame to see benefits from innovation initiatives?

Startups fail and in large quantities. Those that succeed can take years becoming the “overnight success” we read about. Innovating in a corporate setting has both pros and cons, but it’s not likely to change dramatically those odds of succeeding one way or the other. Success will come to some of the ventures, over time.

Identify the economic, non-economic, external and internal metrics. Then track progress against them. Just like a startup, tranche further investment based on progress against those metrics and objectives. Financial return is the ultimate goal, but the near-term measurements can be a wide range of objectives. The goal is to continue to make investments with a level of confidence as to why it’s a smart decision.

As the HBR portfolio article mentioned above discusses, financial results may be appropriate for evaluating core or near-adjacent initiatives on the basis of information that is obtainable and largely accurate. For transformational ideas, however, the only hurdle to receive continued investment maybe the likelihood the company will learn (not earn) from it.

4. Do you really have buy in?

I don’t expect any corporate turmoil to result in the Red Wedding from the 3rd book of Game of Thrones, where the price of betrayal was exceptionally high. Business is war. Building a business is no different. It’s important to have your allies on your side and understand, as best you can, where their interests are and make sure there is buy in.

I don’t expect any corporate turmoil to result in the Red Wedding from the 3rd book of Game of Thrones, where the price of betrayal was exceptionally high. Business is war. Building a business is no different. It’s important to have your allies on your side and understand, as best you can, where their interests are and make sure there is buy in.

It wasn’t as high stakes as a startup investment decision, but once in my career I was completely undermined when I thought I had buy-in from a brilliant but socially awkward engineer. I missed cues that would have told me we were not in agreement. I walked into a setting confident of the goals and outcomes of a meeting, only to find this key “supporter” is in complete disagreement with my defined needs and ask. It’s not fun discovering this at a point of when you’re seeking the continued support of others.

5. Does your organization have a high level of trust?

The focus of the other four questions is around advancing ideas under the assumption that your company is on a path of growth through innovation. A key question to have asked prior to even starting on that path is “can your employees share their observations in a civil manner without fear of persecution?”

With so many unknowns when starting a business, there will be few answers. And even some of the answers will be found to be wrong. We have to remain open to different perspectives and opinions, challenges to our approach and what we think we know. It’s going to come from our internal team as well as the external market.

Having an environment where the team can raise questions and point out problems without fear of reprisal is so important. We don’t want a crucial insight withheld because the cost of sharing it was perceived as too high for that individual.

Those are my top five. What others should be added to the list?